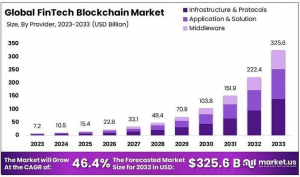

FinTech Blockchain Market Was Value is Expected to Reach USD 325.6 Billion by 2033, with a CAGR of 46.4%, Here’s How…

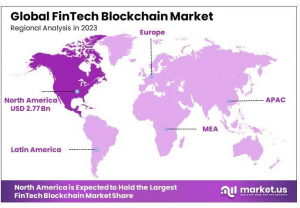

In 2023, North America accounted for 38.5%, reflecting the region’s leadership in blockchain adoption…

NEW YORK, NY, UNITED STATES, February 24, 2025 /EINPresswire.com/ — The global FinTech Blockchain market is experiencing rapid growth, with projections indicating it will reach USD 325.6 billion by 2033, up from USD 7.2 billion in 2023. This expansion reflects a robust CAGR of 46.4% during the forecast period from 2024 to 2033.

This growth is driven by the integration of blockchain technology into financial services, providing enhanced security, transparency, and efficiency. North America dominated the market in 2023, commanding a 38.5% share due to its advanced technological infrastructure and leadership in blockchain adoption.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=128197

Key applications driving the market include payments, clearing and settlement, and compliance management, where blockchain’s ability to facilitate secure and cost-effective transactions without intermediaries is crucial.

The demand for digital financial services, accelerated by the COVID-19 pandemic, further boosts blockchain adoption in finance. Moreover, the rise of decentralized finance (DeFi) platforms offers significant opportunities for innovative financial products that bypass traditional institutions, reshaping the financial landscape.

Experts Review

Experts highlight the transformative impact of blockchain on financial technologies (FinTech), driven by its ability to streamline processes, reduce costs, and enhance security. Blockchain technology is fundamentally altering how financial transactions are processed, providing a decentralized ledger that eliminates the need for traditional intermediaries. This evolution supports a broader movement towards digitalization in finance, meeting modern consumer demands for quick, secure transactions.

However, the market also faces challenges, such as regulatory uncertainties and the technical complexities associated with deploying blockchain technology across financial infrastructures. Addressing these challenges is vital for broader adoption and operational effectiveness.

Nevertheless, the market offers substantial opportunities, particularly in areas like cross-border payments and asset tokenization, where blockchain’s transparency and efficiency are particularly advantageous.

The integration of blockchain into central bank digital currencies (CBDCs) and Blockchain-as-a-Service (BaaS) further expands market potential, enabling more accessible and scalable deployments for financial services. By harnessing these trends, financial institutions can significantly enhance their service offerings, competitiveness, and compliance in a rapidly evolving market environment.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/fintech-blockchain-market/free-sample/

Enterprise Size Analysis:

Large enterprises dominated the FinTech Blockchain market by enterprise size, accounting for 65.5% in 2023. This dominance is attributed to their broader capacity to invest in and implement complex blockchain solutions at scale. Large organizations are leveraging blockchain to enhance transaction security, compliance, and operational efficiency, offering them a competitive advantage in a rapidly digitizing economy.

As blockchain solutions become more affordable, a shift is expected where small and medium-sized enterprises (SMEs) will also increasingly adopt this technology. This shift will further spur innovation within the FinTech Blockchain sector, fostering diverse applications that cater to various business sizes and needs.

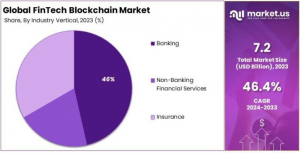

Industry Vertical Analysis:

The banking sector leads with a 46% market share, primarily due to blockchain’s profound impact on transactional security and operational efficiency. Blockchain technology addresses pressing banking issues such as fraud risk and compliance, which are critical as regulatory scrutiny intensifies globally.

Non-banking financial services and the insurance sector also stand to benefit significantly from blockchain technologies, particularly in streamlining claims processes and enhancing asset management transparency. As more financial institutions recognize blockchain’s potential to fundamentally transform financial interactions and operational models, its adoption across these verticals is poised for considerable growth in the coming years, driven by technological innovation and strategic integrations.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=128197

Key Drivers:

Transparency and Security: Blockchain’s decentralized ledger system significantly enhances transparency and security, crucial for reducing fraud and building trust, particularly in the financial services sector. Blockchain’s ability to verify and trace transaction histories is a compelling draw for financial institutions aiming to safeguard transactions.

Cost Efficiency: By cutting out intermediaries in financial transactions, blockchain reduces costs and makes cross-border payments more accessible and affordable—a significant benefit in a globalized economy.

Decentralized Finance (DeFi): The rise of DeFi platforms enables peer-to-peer financial transactions without traditional institutions, reshaping the financial landscape and driving further blockchain adoption.

Challenges:

Regulatory Uncertainty: A lack of clear guidelines for blockchain in financial services creates operational uncertainty. As a result, companies may hesitate to fully integrate blockchain solutions into their operations.

Scalability Issues: Public blockchains often struggle with scalability, leading to slow transaction speeds and higher costs, particularly during peak demand periods. This limitation can hamper widespread adoption.

Integration Complexity: Incorporating blockchain with legacy financial systems can be challenging, requiring significant changes without disrupting existing operations.

Growth Opportunities:

The rapid rise of decentralized finance, smart contracts, and asset tokenization are key growth factors. These technologies facilitate efficient peer-to-peer financial services, streamline complex transactions, and enhance asset liquidity. Additionally, blockchain-based payment systems, particularly for cross-border transactions, promise significant growth opportunities.

Regions like North America, with a 38.5% market share, continue to lead due to their robust financial sectors and regulatory environments that support blockchain innovation. As more financial institutions integrate blockchain for enhanced efficiency, fraud reduction, and customer experience improvements, further growth and innovation are anticipated across all regions.

In summary, the FinTech Blockchain market is positioned for substantial growth. Although regulatory and scalability challenges exist, innovations in DeFi, smart contracts, and tokenization will drive expansion and transformation within financial services. Key players like IBM, Ripple, and Coinbase will continue to lead the market by offering cutting-edge solutions that enhance transaction security and efficiency, making blockchain technology increasingly accessible to businesses and consumers worldwide.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/fintech-blockchain-market/free-sample/

Conclusion

The FinTech Blockchain market is set for robust growth, driven by the increasing need for secure, cost-effective, and efficient financial solutions. Despite challenges like regulatory uncertainties and integration complexities, the market offers vast opportunities in decentralized finance, cross-border payments, and asset tokenization.

As technology evolves and regulatory frameworks become clearer, blockchain’s transformative potential will be realized across the financial sector. Key players continue to innovate, leading to broader adoption and deeper integration of blockchain technologies. This trend will enhance transaction security, operational efficiency, and financial inclusivity, making blockchain a pivotal element in the future of financial services.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Financial Planning Software Market – https://market.us/report/financial-planning-software-market/

Educational Tourism Market – https://market.us/report/educational-tourism-market/

Edge Security Market – https://market.us/report/edge-security-market/

Energy Security Market – https://market.us/report/energy-security-market/

North America Digital Avatar Market – https://market.us/report/north-america-digital-avatar-market/

Next Generation Data Storage Market – https://market.us/report/next-generation-data-storage-market/

Anime Market – https://market.us/report/anime-market/

5G Security Market – https://market.us/report/5g-security-market/

AI in Higher Education Market – https://market.us/report/ai-in-higher-education-market/

Data Center Cooling Market – https://market.us/report/data-center-cooling-market/

Hybrid Cloud Market – https://market.us/report/hybrid-cloud-market/

Maritime Security Market – https://market.us/report/maritime-security-market/

Photoelectric Sensors Market – https://market.us/report/photoelectric-sensors-market/

Aerospace Coating Market – https://market.us/report/aerospace-coating-market/

AI in Machine Learning Market – https://market.us/report/ai-in-machine-learning-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()