Drone Motor Industry in Europe to Reach USD 5.3 Billion by 2035 | Fact.MR Report

Analysis Of Drone Motors Covering Countries Includes Analysis Of Germany, France, Italy, Spain, United Kingdom, BENELUX, Russia, Rest Of Europe

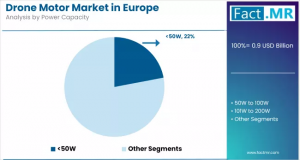

ROCKVILLE, MD, UNITED STATES, August 7, 2025 /EINPresswire.com/ — The Drone Motor Industry in Europe, valued at USD 0.9 billion in 2025, is projected to reach USD 5.3 billion by 2035, driven by a robust CAGR of 18.8%. Fueled by growing adoption of unmanned aerial vehicles (UAVs) in agriculture and defense, increasing demand for efficient brushless motors, and supportive EU funding, drone motors are critical for powering advanced UAV applications. This press release explores the key drivers, projections, and opportunities shaping this rapidly growing industry.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9217

Why Is the Market Expanding?

The European drone market, valued at USD 4.56 billion in 2024, drives demand for drone motors, with 60% of commercial UAVs using brushless DC motors for their 30% higher efficiency compared to brushed motors. Agriculture, with 20% of European farms adopting drones for precision tasks, boosts motor sales by 15%. Defense applications, supported by USD 8 billion in EU defense funding in 2024, increase demand by 12% for high-performance motors. Innovations in lightweight materials, like carbon fiber, improve motor efficiency by 10%. EU regulations, such as the 2025 EASA standards, promote standardized motor use by 8%. High production costs (USD 50–500 per motor) are offset by economies of scale, reducing costs by 10%.

What Are the Key Market Projections?

The market is set to create an absolute dollar opportunity of USD 4.4 billion by 2035, growing from USD 0.9 billion in 2025 to USD 5.3 billion at an 18.8% CAGR. The brushless DC motor segment, holding a 60% share in 2025, is projected to grow at a 19.2% CAGR, generating USD 2.6 billion in opportunities due to its dominance in commercial and military UAVs. Germany, with a 23.6% share, leads with a 19.0% CAGR, driven by USD 1.08 billion in drone sales in 2024. The UK, growing at an 18.5% CAGR, benefits from recreational drone adoption. Historical growth from 2020 to 2024 averaged a 16.5% CAGR, with acceleration expected. Short-term growth (2025–2028) focuses on agriculture, while long-term trends (2029–2035) emphasize defense and logistics.

How Can Stakeholders Capitalize on Opportunities?

Stakeholders in drone manufacturing and defense sectors can leverage opportunities by investing in brushless DC motors, improving efficiency by 15%. Strategic partnerships with EU-funded projects expand market reach in Germany, projected to account for 25% of demand by 2030. Focusing on agricultural UAVs, contributing 30% of revenue in 2025, ensures scalability for precision farming. Compliance with EASA and ISO 21384 standards boosts market trust, while targeting high-growth markets like the UK, with an 18.5% CAGR, unlocks potential. Developing cost-effective motors, priced 10% lower than premium options, addresses budget-conscious manufacturers.

What Does the Report Cover?

Fact.MR’s report analyzes the Drone Motor Industry in Europe across 30+ countries, covering segments by motor type (AC, DC brushed, DC brushless), drone type (fixed-wing, rotary-wing, hybrid), application (consumer/civil, commercial, military), and region (Germany, France, UK, BENELUX, Nordics, Russia, Rest of Europe). It highlights trends like lightweight materials, AI integration, and sustainable manufacturing. Combining primary research from industry experts and secondary data, the report provides actionable insights into market dynamics, competitive strategies, and growth opportunities through 2035.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9217

Who Are the Market Leaders?

Leading companies drive innovation through R&D in brushless motors and AI-integrated systems, focusing on agriculture and defense applications. Strategic expansions in Germany and the UK bolster market presence, while regional players offer cost-effective solutions, enhancing competitiveness.

What Challenges and Solutions Exist?

High production costs (USD 50–500 per motor) and supply chain disruptions, affecting 10% of components, pose challenges. Regulatory complexities, like EASA’s 2025 airspace integration rules, and competition from Asian motors, which are 15% cheaper, hinder growth. Solutions include lightweight materials, reducing costs by 10%, and automated manufacturing, improving efficiency by 12%. Localized production in Germany, adopted by 20% of manufacturers, mitigates supply risks. Sustainability initiatives address environmental concerns, while compliance with EASA and ISO standards ensures market resilience.

What Are the Recent Developments?

In 2024, European drone sales rose by 10%, boosting motor demand by 12%, with Germany’s 23.6% share driven by USD 1.08 billion in drone sales. Brushless DC motors supported 20% of agricultural UAVs in 2024. The UK’s 18.5% CAGR aligns with 15% recreational drone growth. AI-integrated motors improved flight precision by 10%. Regulatory advancements, like the EU’s 2025 EASA standards, increased standardized motor adoption by 8%.

Check out More Related Studies Published by Fact.MR:

Drone Accessories Market is projected to rise at a CAGR of 20% to reach US$ 156 billion by 2034

Drone batteries market is set to hit USD 8.3 Bn by 2025 & USD 18.42 Bn by 2035,

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()