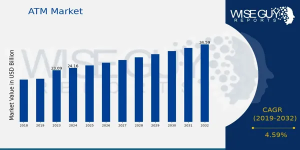

ATM Market Forecast 2032 | Share Reach $34.6 Billion, At a CAGR of 4.59%

ATM Market Research Report: By Deployment Type, ATM Type, End Use, Service Type, Regional

GA, UNITED STATES, January 10, 2025 /EINPresswire.com/ — The global Automated Teller Machine (ATM) market was valued at USD 23.09 billion in 2023 and is projected to experience robust growth, expanding from USD 24.16 billion in 2024 to USD 34.6 billion by 2032, at a compound annual growth rate (CAGR) of 4.59% during the forecast period from 2025 to 2032. The demand for ATMs is driven by the increasing reliance on digital banking and cashless transactions, financial sector advancements, and the growing need for enhanced security features.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐀𝐓𝐌 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐜𝐥𝐮𝐝𝐞

• SaaS ATM

• Global Cash Access

• Toshiba

• Stanchion

• GRG Banking

• Nautilus Hyosung

• Oman Investment Authority

• Fujitsu

• NCR Corporation

• Wincor Nixdorf

• Hitachi

• CPI Card Group

• Innovative Technology

• Cryptocurrency ATM

• Diebold Nixdorf, among others

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬

https://www.wiseguyreports.com/sample-request?id=651112

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

• Growing Adoption of Digital Banking: As more consumers shift towards digital banking, the role of ATMs remains essential in providing cash access and other essential services, particularly in areas with limited access to bank branches.

• Demand for Cashless Transactions: Although digital payments are rising, ATMs continue to serve as crucial touchpoints for cash withdrawals, deposits, and other banking services, particularly in regions with underdeveloped banking infrastructure.

• Security Advancements: With the growing threat of fraud and cybercrime, the ATM industry has been focusing on implementing advanced security technologies such as biometric authentication and EMV chip card readers.

• Increasing Financial Inclusion: Emerging economies are experiencing rapid expansion in ATM installations, driving the market’s growth, as ATMs serve as essential tools for financial inclusion, enabling access to banking services in remote regions.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.wiseguyreports.com/reports/atm-market

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

By Type

On-Site ATMs: These are installed at bank branches or financial institutions, providing traditional services such as withdrawals, deposits, and balance checks.

Off-Site ATMs: Typically located at convenience stores, malls, airports, or other public locations, off-site ATMs are strategically placed for greater accessibility to customers.

Smart ATMs: These next-generation machines allow for additional functionalities beyond traditional services, such as bill payments, mobile recharges, and account management, improving customer convenience.

By Deployment

Traditional ATMs: These machines perform basic functions, including cash withdrawal, balance inquiries, and funds transfer.

Cash-Recycling ATMs: These advanced ATMs can accept and dispense cash, providing an efficient cash management solution for both customers and financial institutions.

Interactive Teller Machines (ITMs): ITMs combine ATM functionality with remote video banking, offering customers the ability to speak to a teller for more complex banking transactions.

By End-User

Banks: Banks are the largest consumers of ATMs, providing self-service machines for routine transactions.

Non-Banking Financial Institutions (NBFIs): These institutions, including retail outlets and post offices, are increasingly adopting ATMs to extend their reach and services to customers.

Retail: Retail establishments are deploying ATMs for customer convenience and to reduce the cost of maintaining a bank branch.

By Region

North America: North America holds a significant share of the ATM market, driven by advanced financial infrastructure, increased demand for contactless ATM transactions, and high ATM penetration.

Europe: The European ATM market is poised for growth due to the region’s strong financial services sector and the push for smart ATMs that support digital banking services.

Asia-Pacific: The Asia-Pacific region is expected to witness the highest growth during the forecast period due to increased adoption of ATMs in emerging economies such as India, China, and Southeast Asian nations.

Middle East & Africa: The market in this region is experiencing growth with the rising number of bank branches and ATMs to cater to the growing banking and financial needs.

Latin America: Latin America is seeing steady growth in ATM installations as financial inclusion initiatives and government policies are improving access to banking services.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=651112

The ATM market is poised for consistent growth, driven by advancements in banking technology, increased demand for cashless transactions, and the expanding reach of financial services in emerging economies. The evolution towards smarter, more secure ATMs is expected to shape the market’s future, ensuring that ATMs remain an essential part of the global financial landscape.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

RFID Antennas Market

Resistive Touch Screen Market

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()