Amazon Prime-Week Price War Cools Consumer Durables Price Growth in July

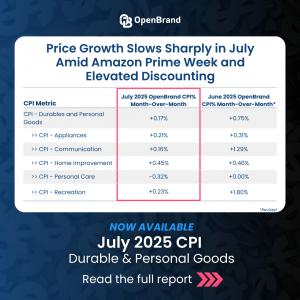

The July 2025 report of the OpenBrand Consumer Price Index (CPI) registers a 0.17% month-over-month (MoM)increase, down from June’s revised 0.75%.

SAN DIEGO, CA, UNITED STATES, August 8, 2025 /EINPresswire.com/ — The U.S. durable and personal goods inflation slowed sharply in July. The July 2025 report of the OpenBrand Consumer Price Index (CPI) registers a 0.17% month-over-month (MoM) increase, down from June’s revised 0.75%.

“Retailers, not tariffs, did the heavy lifting in July,” said Ralph McLaughlin, Chief Economist at OpenBrand. “Amazon Prime Week set off a wave of price competition. Merchants broadened the share of items on promotion while keeping markdown percentages steady, trimming inflation without eviscerating margins.”

Retailer and Discount Highlights:

– Discount frequency jumped to 23.1% of tracked SKUs, the highest since December, while the average markdown held at 20.2%.

– Walmart discounted nearly 60% of products during Amazon Prime Week, out-pacing Amazon (46.2%), BestBuy (29.1%), and Target (2.7%).

– Walmart’s promo share was almost triple its baseline (59 % vs. 21.5%).

– On discounted items, Walmart’s average cut reached 26.8%, ahead of Amazon (21.2%) and BestBuy (20.1%).

Category Pulse:

– Appliances +0.21%, Communication +0.16%, Recreation +0.23% – all markedly slower than June.

– Personal Care fell 0.32%on the back of a 4-percentage-point surge in discount frequency.

– Home-Improvement prices were flat at +0.45%, but discounting crept higher for the second month.

Why It Matters:

Retailers widened the promo aisle rather than deepening cuts, a tactic that tempers inflation while preserving margin. Competitive pressure from Walmart’s aggressive Prime Week stance is now a measurable counterweight to tariff-driven cost increases. Brands and merchants with real-time SKU-level visibility can pivot pricing and inventory strategies faster than rivals relying on delayed headline data.

Read the full report: openbrand.com/cpi

About the OpenBrand CPI

The OpenBrand CPI – Durable and Personal Goods tracks pricing, promotion, and availability for 200,000+ SKUs, more than double the coverage of the Bureau of Labor Statistics CPI in these categories. The index delivers earlier, more granular insight into consumer-goods inflation for retailers, manufacturers, and policymakers.

Press contact: press@openbrand.com

Media interviews with Ralph McLaughlin: ralph@openbrand.com

About OpenBrand:

OpenBrand is the leading real-time market intelligence platform for the consumer durables market. Its unique optical web collection and AI-based processing technology enable the creation and delivery of the most accurate, dependable, and timely competitive intelligence and market measurement data. Brands and retailers leverage the data and analytics to understand why they are winning or losing, so they can make the strategic adjustments they need to succeed.

Sidney Waterfall

OpenBrand

+1 502-593-0038

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()