Asset-Backed Securities Market Size, Share, Trends, Growth Opportunities, Key Players and Forecast to 2034

Asset-backed Securities Market Research Report By, Asset Class, Security Structure, Credit Rating, Maturity, Regional

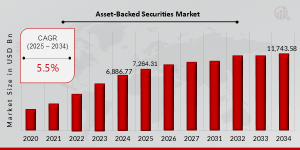

VA, UNITED STATES, August 7, 2025 /EINPresswire.com/ — The Asset-Backed Securities (ABS) Market is expanding steadily, supported by evolving capital markets, demand for diversified investment options, and rising consumer and business lending. According to recent MRFR analysis, the Asset-Backed Securities Market Size was estimated at USD 6,886.77 billion in 2024. The market is projected to grow from USD 7,264.30 billion in 2025 to USD 11,743.57 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.48% during the forecast period (2025–2034).

Key Market Drivers

1. Diversification of Credit Risk- ABS allow financial institutions to distribute and manage credit risk more efficiently by converting loans into tradable securities, attracting institutional investors.

2. Expansion of Consumer and SME Lending- Growing issuance of auto loans, credit card receivables, student loans, and SME financing supports the generation of underlying assets for securitization.

3. Favorable Interest Rate Environment- Low-interest rates have driven demand for yield-bearing securities, making ABS an attractive fixed-income investment tool.

4. Regulatory Support and Financial Innovation- Efforts to improve market transparency, standardized structuring, and post-2008 reforms have enhanced investor confidence in ABS products.

Get a FREE Sample Report – https://www.marketresearchfuture.com/sample_request/23890

Market Challenges

1. Credit and Default Risks- The performance of ABS depends heavily on the credit quality of underlying assets, exposing investors to potential default risks in times of economic downturn.

2. Complex Structuring and Valuation- The complexity of tranche-based structures, varied collateral pools, and legal frameworks can create valuation and risk-assessment challenges.

3. Regulatory Compliance Costs- Compliance with stringent global and regional regulations (e.g., Basel III, Dodd-Frank) can increase operational costs for issuers and servicers.

Key Players in the Asset-Backed Securities Market

• Citigroup Inc.

• Bank of America Corporation

• JP Morgan Chase & Co.

• Credit Suisse Group AG

• Wells Fargo & Company

• Morgan Stanley

• Barclays PLC

• Deutsche Bank AG

• UBS Group AG

• Goldman Sachs Group Inc.

These players actively structure, issue, trade, and service ABS transactions globally, across various asset classes including mortgages, auto loans, student loans, and corporate receivables.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23890

Market Segmentation

1. By Type

• Residential Mortgage-Backed Securities (RMBS)

• Commercial Mortgage-Backed Securities (CMBS)

• Auto Loan ABS

• Credit Card ABS

• Student Loan ABS

• Collateralized Loan Obligations (CLOs)

2. By End-User

• Institutional Investors

• Banks and Financial Institutions

• Pension Funds

• Insurance Companies

• Hedge Funds

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/asset-backed-securities-market-23890

3. By Region

• North America: Largest ABS market, with high securitization activity in the U.S.

• Europe: Significant growth in the UK, Germany, and Netherlands due to regulatory reforms.

• Asia-Pacific: Growing adoption in China, Japan, and Australia with expanding credit markets.

• Latin America & Middle East: Nascent but emerging ABS structures gaining traction.

The Asset-Backed Securities Market is expected to continue its upward trajectory, driven by financial innovation, institutional demand, and digital securitization platforms. As regulatory environments stabilize and data analytics improve credit modeling, ABS issuance is set to become more dynamic and investor-friendly. The future of the market will also depend on macroeconomic trends, credit performance, and fintech disruption in structured finance.

Related Trending Report:

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()