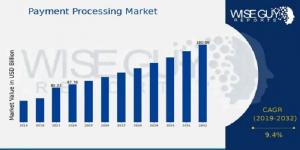

Payment Processing Market to Hit $180.0 Billion By 2032, US Market’s Role in Payment Processing Growth

The future of commerce depends on seamless transactions, and the US payment processing industry is leading the way

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ — According to a new report published by WiseGuy Reports, The Payment Processing Market Industry is expected to grow from 87.76 USD Billion in 2024 to 180.0 USD Billion by 2032.

The payment processing market has evolved significantly over the years, driven by rapid technological advancements and the increasing demand for seamless and secure transactions. Payment processing refers to the mechanisms and systems that facilitate the exchange of funds between buyers and sellers, ensuring smooth and efficient transactions. The market is experiencing substantial growth, largely attributed to the growing adoption of digital payments, mobile wallets, and e-commerce platforms. The need for faster, more reliable, and secure payment solutions is pushing businesses and consumers toward adopting innovative payment technologies. As consumers and businesses alike demand convenience, the payment processing sector is expected to see continued growth, expanding across various industries and geographical regions.

Get An Exclusive Sample of the Research Report at – https://www.wiseguyreports.com/sample-request?id=654167

The payment processing market can be segmented into several categories based on different factors such as solution types, deployment modes, and end-users. The market is typically divided into three main solution categories: payment gateway solutions, payment security and fraud prevention solutions, and payment analytics solutions. Payment gateway solutions are one of the most widely used services, facilitating smooth, fast, and secure transactions between merchants and customers. Payment security solutions are essential for preventing fraud and securing payment data during transactions, while payment analytics solutions offer valuable insights into transaction patterns, helping businesses optimize their payment processes. From a deployment perspective, the market can be segmented into on-premises and cloud-based payment processing solutions. The cloud-based segment is gaining considerable traction due to its flexibility, cost-effectiveness, and scalability. Additionally, the payment processing market caters to various industries, including retail, BFSI (banking, financial services, and insurance), healthcare, hospitality, and transportation, each requiring specific payment solutions tailored to their unique needs.

Buy Latest Edition of Market Study Now – https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=654167

The payment processing market is characterized by several dynamic forces that influence its growth and development. One of the primary drivers is the increasing adoption of e-commerce and mobile payment solutions. With the surge in online shopping and mobile applications, businesses are continuously looking for ways to offer seamless payment experiences to their customers. The rise of digital wallets and contactless payments is also contributing to the market’s expansion, with consumers demanding faster and more convenient ways to pay. Moreover, the ongoing shift toward a cashless society, coupled with the growing awareness of cybersecurity risks, is prompting businesses to adopt secure and reliable payment solutions. On the other hand, the market also faces certain challenges, such as regulatory complexities, data privacy concerns, and the need for constant innovation to stay ahead of competitors. Additionally, there is an increasing demand for solutions that support multiple currencies and global payment methods, especially for businesses operating internationally.

In recent years, the payment processing market has witnessed significant developments, driven by advancements in technology, changing consumer behavior, and evolving regulatory frameworks. One of the most notable trends is the rise of mobile payment platforms, which allow users to make payments using their smartphones. Companies such as Apple Pay, Google Pay, and Samsung Pay have revolutionized the way consumers make transactions, offering secure and contactless payment options. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) algorithms into payment processing systems has enhanced fraud detection, enabling real-time analysis of transaction data to identify potential security threats. Blockchain technology is also making waves in the payment processing market, offering decentralized, secure, and transparent solutions for cross-border payments. Additionally, the growing emphasis on data privacy regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. has prompted payment processors to implement stricter security measures and data protection policies to ensure compliance with global standards.

Key Companies in the Payment Processing Market Include:

• Payoneer

• Alipay

• PayPal

• Fiserv

• Zelle

• Nexi

• MasterCard

• Stripe

• Square

• Worldpay

• Discover

• American Express

• Adyen

• WeChat Pay

• Visa

Browse In-depth Market Research Report – https://www.wiseguyreports.com/reports/payment-processing-market

Regionally, the payment processing market exhibits distinct trends, with varying levels of adoption and growth across different parts of the world. North America and Europe are currently the largest markets for payment processing services, driven by the widespread use of digital payments and the presence of established financial institutions and payment service providers. The United States, in particular, is a significant contributor to the North American market, with a large number of businesses adopting digital payment solutions to cater to the needs of tech-savvy consumers. In Europe, countries such as the United Kingdom, Germany, and France are leading the charge, with extensive infrastructure supporting digital payment platforms.

Meanwhile, the Asia Pacific region is experiencing the fastest growth in the payment processing market, driven by the increasing number of smartphone users, the growing popularity of mobile payments, and the expanding e-commerce sector. Countries like China, India, and Japan are leading the adoption of digital payments in the region, with innovative solutions like QR code-based payments gaining traction. The Latin American and Middle Eastern regions are also witnessing growth, albeit at a slower pace, due to increasing smartphone penetration and a shift toward digital payment solutions. However, these regions still face challenges related to regulatory hurdles and lack of infrastructure in certain areas.

The payment processing market is poised for continued growth and transformation, fueled by innovations in digital payments, mobile wallets, and security technologies. As businesses seek to offer convenient, secure, and fast payment options to their customers, the demand for efficient payment processing solutions will remain high. With the increasing adoption of cloud-based solutions, AI, and blockchain technology, the market is set to evolve rapidly, opening new opportunities for businesses and consumers alike. As the global economy becomes more digital and interconnected, the payment processing market will continue to play a crucial role in facilitating transactions and driving economic growth

Check Out More Related Insights:

Document Outsource Market –

https://www.wiseguyreports.com/reports/document-outsource-market

Core Hr Software Market –

https://www.wiseguyreports.com/reports/core-hr-software-market

Software Consulting Market –

https://www.wiseguyreports.com/reports/software-consulting-market

Statistics Software Market –

https://www.wiseguyreports.com/reports/statistics-software-market

Supply Chain Analytic Market –

https://www.wiseguyreports.com/reports/supply-chain-analytic-market

Textile Waste Management Market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune – 411028

Sales :+162 825 80070 (US) | +44 203 500 2763 (UK)

Mail :info@wiseguyreports.com

Sachin Salunkhe

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()